In 2016, Google rented 1000 acres of a historic California airbase in the San Francisco Bay Area for $1.16 billion via a 60-year lease. Annual M&O is expected to be $6.3 million. In addition, Google will refurbish three hangars at a cost of $2.6 million 4 years from now. Assuming the $1.16 billion represents the present worth of only the lease, what is the equivalent AW of the transaction over the 60-year period at an interest rate of 15% per year?

What will be an ideal response?

(a) From the spreadsheet, the difference between the 60-year PW value and the CC value is

$-274,578 with CC being the larger amount, as expected.

(b) Google must obtain revenues of the CR amounts each year (column B) plus the annual M&O costs. The CR goes down as n increases; but, the M&O is constant, as estimated at $6.3 million per year.

ANSWER.png)

You might also like to view...

Air compressors are started directly or indirectly on a call for more air by a ____.

a. thermostat b. float switch c. pressure switch d. limit switch

Most pencil erasers have a(n) ____ action on the paper as they are used to erase pencil marks.

A. moisturizing B. saturating C. abrasive D. greasing

Rigid inserts are used _____.

a. only on cold applications b. to prevent insulation from being compressed c. to provide structural support for the pipe d. to keep pipe away from the ceiling

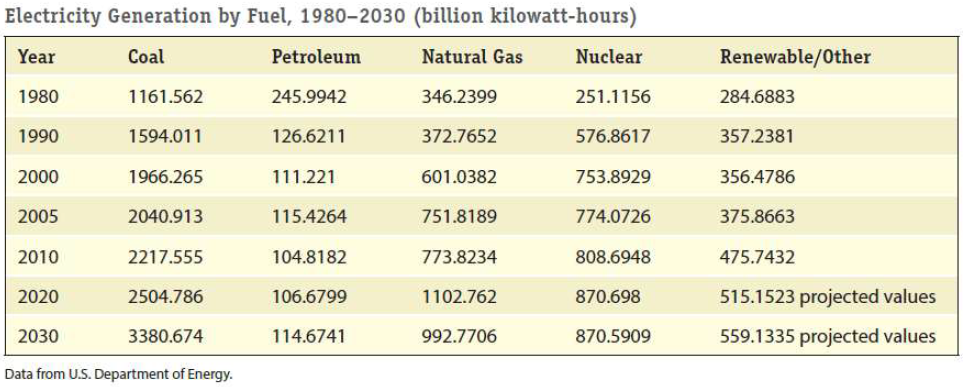

How many kilograms of coal could be saved if we were to increase the average efficiency of power plants by 1% to 36%?