According to the early Keynesians,

a. the money demand function was unstable; the interest elasticity of money demand was extremely high; and, as a consequence, changes in the quantity of money did not have important predictable effects on the level of economic activity.

b. the money demand function was stable; the interest elasticity of money demand was low; and, as a consequence, changes in the quantity of money did not have important predictable effects on the level of economic activity.

c. the money demand function was unstable; the interest elasticity of money demand was low; and, therefore, changes in the quantity of money did not have important effects on the level of economic activity.

d. the money demand function was stable; the interest elasticity of money demand was high; and, therefore, changes in the quantity of money did have important effects on the level of economic activity.

A

You might also like to view...

If the nominal exchange rate were to be expressed as the number of units of domestic currency per unit of foreign currency, and that rate decreases, then the domestic currency has:

A. become overvalued. B. become undervalued. C. appreciated. D. depreciated.

If advertising were used to strengthen brand loyalty, you would expect: a. demand for the product to become more elastic

b. consumers to become less sensitive to price differences among similar goods. c. firms to lower price in order to increase revenue. d. that consumer demand for related products would be unaffected.

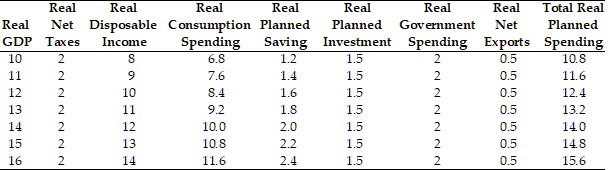

Note: Amounts in $ trillionsRefer to the above table. Which variables in the table are NOT autonomous?

Note: Amounts in $ trillionsRefer to the above table. Which variables in the table are NOT autonomous?

A. planned investment, net exports, and government spending B. taxes, government spending, and saving C. planned saving only D. planned consumption and planned saving

An example of an automatic stabilizer is

A. unemployment compensation. B. a constant money supply rule. C. a deliberate increase in government spending to fight recession. D. a newly enacted surtax to slow down an overheated economy.