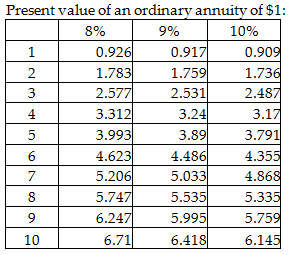

A company is considering an iron ore extraction project that requires an initial investment of $512,000 and will yield annual cash inflows of $156,000 for four years. The company's discount rate is 9%. What is the NPV of the project?

A) $6,560

B) $(102,400)

C) $102,400

D) $(6,560)

D) $(6,560)

Business

You might also like to view...

If a student leaves a book bag in class by accident and the professor takes possession to safeguard the bag, a bailment has been formed.

Answer the following statement true (T) or false (F)

Business

Financial plans provide direction to annual budgets.

Answer the following statement true (T) or false (F)

Business

What is the standard error of estimate, and what role does it play in simple linear regression and correlation analysis?

Business

What are the steps to be taken in preparing IFRS financial statements for the first time?

What will be an ideal response?

Business