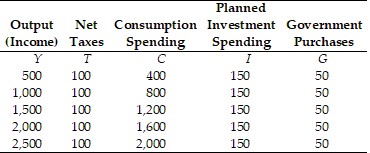

Refer to the information provided in Table 24.2 below to answer the question(s) that follow. Table 24.2 Refer to Table 24.2. At an output level of $1,500, disposable income

Refer to Table 24.2. At an output level of $1,500, disposable income

A. is $1,000.

B. is $1,200.

C. is $1,400.

D. cannot be determined from this information.

Answer: C

You might also like to view...

The more money an average household spends on one specific type of good or service per month, the

A) smaller the relative importance of that item in the CPI market basket. B) larger the relative importance of that item in the CPI market basket. C) costlier it will be to conduct the Consumer Expenditure Survey. D) less significant an increase in the price of that good or service will be for the household. E) more frequently its price is checked when calculating the CPI.

Manisha could work for another firm making $10,000 per month, but she decides to open her own gourmet cheese store and pay herself $2,000 per month

In her first month of operations, she spends $6,000 on cheese, $1,000 on other items, and $2,500 on rent. She had a great opening month, and brought in revenues of $14,500. What are Manisha's economic profits? A) $3,000 B) $4,000 C) -$5,000 D) -$6,000

In the middle of a severe recession, Congress passes an increase in the level of unemployment benefits. This would be considered by economists as a

a. positive tax. b. negative tax. c. form of government purchases. d. variable tax.

You have driven 800 miles on a vacation and then you notice that you are only 15 miles from an attraction you hadn't known about, but would really like to see. In computing the opportunity cost of visiting this attraction you had not planned to visit, you should include

a. both the cost of driving the first 800 miles and the next 15 miles. b. the cost of driving the first 800 miles, but not the cost of driving the next 15 miles. c. the cost of driving the next 15 miles, but not the cost of driving the first 800 miles. d. neither the cost of driving the first 800 miles nor the cost of driving the next 15 miles.