Which of the following is not an argument in favor of requiring the government to balance its budget?

a. Government debt imposes higher taxes or more borrowing on future generations.

b. A balanced budget will smooth the business cycle.

c. Deficits lower national saving.

d. Recent history shows that Congress will run deficits even when deficits are not justified by war or recession.

b

You might also like to view...

________ refers to a government's failure to repay its debt

A) Intolerance B) Distortion C) Seignorage D) Repudiation

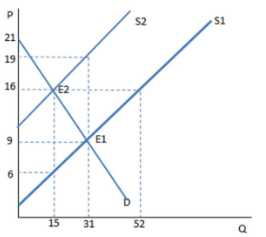

Suppose a tax on sellers has been imposed in the graph shown. Once the tax is in place, the buyers purchase ____ units and pay ____ for each one.

A. 15; $16

B. 15; $6

C. 31; $9

D. 31; $19

If interest rates increase, the government debt becomes:

A. more expensive to pay. B. less expensive to pay. C. more volatile. D. less of a burden.

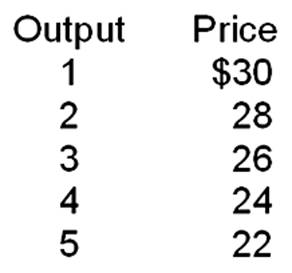

The marginal revenue that would be derived from producing a fifth unit of output is

A. $18.

B. $16.

C. $14.

D. $12.