Combine a graph showing the interest parity condition and one showing money demand and supply to demonstrate simultaneous equilibrium in the money market and the foreign exchange market. How would an increase in the U.S

money supply affect the Dollar/Euro exchange rate and the U.S. interest rate? Illustrate your answer graphically and explain.

Above the axis is depicted the foreign exchange market, where changes in the rate of return on the dollar are mapped into changes in the exchange rate. Below the axis is depicted the U.S. money market and shows the relation between the rate of return on the dollar and U.S. real money holdings. The mechanism works as follows. Consider an increase in the U.S. real money holdings. Supply and demand dictate that the demand for money must increase, so the rate of return must lower to equilibrate at point 2. The lower rate of return on the dollar will cause the dollar to depreciate (exchange rate moves to point ).

You might also like to view...

Consider the opportunity costs of producing goods X and Y that are listed for the four individuals above. Which person has a comparative advantage in producing good X?

A) Pramilla B) Sam C) George D) Lucas

When there few close substitutes available for a good, demand tends to be

A) perfectly inelastic. B) perfectly elastic. C) relatively inelastic. D) relatively elastic.

A farmer producing bushels of soybeans in the perfectly competitive soybean industry is currently maximizing profits. If the market price of soybeans increases and the farmer adjusts output to the new price, he will produce ________ soybeans and make ________ profit.

A. the same bushels of; the same B. fewer; the same C. more; more D. fewer; less

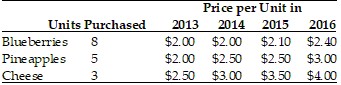

Refer to the information provided in Table 22.5 below to answer the question(s) that follow.

Table 22.5 Refer to Table 22.5. If 2014 is the base year, the price index in 2013 is

Refer to Table 22.5. If 2014 is the base year, the price index in 2013 is

A. 89.3. B. 96.0. C. 104.0. D. 111.9.