Which of the following is an interest-earning asset of banks?

a. Required reserves.

b. Checkable deposits.

c. Excess reserves.

d. None of these are interest-earning assets of banks.

d

You might also like to view...

Assume the price of Nikes decreases. As a result, consumers increase the quantity of Nikes purchased each year and purchase fewer Reeboks. This is an example of the:

a. substitution effect. b. income effect. c. utility effect. d. consumption effect.

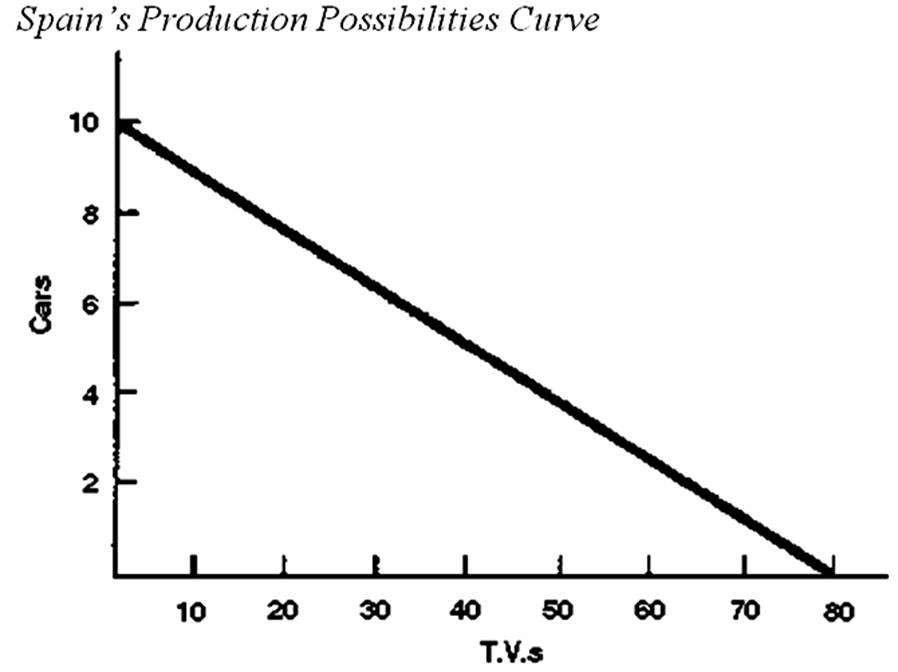

What is Spain's domestic exchange equation?

Which of the following is a disadvantage of? partnerships?

A. Potential for conflict B. Simplicity C. Longevity D. More resources E. Single layer of taxation

Which of the following is not an example of inflation causing a redistribution of income because the inflation was unanticipated?

A) A firm signs a 3-year contract with a union based on a 2 percent anticipated rate of inflation per year, and the actual rate of inflation ends up being 7 percent per year. B) A worker receives a raise in salary that is less than the rate of inflation, because management under-predicted inflation. C) Firms have to hire an extra worker to change prices in its store because of inflation. D) A bank collects a lower amount of interest from a loan because inflation was under-predicted.