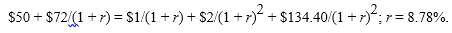

$50. At the end of year 1, you receive a $1 dividend and buy one more share for $72. At the end of year 2, you receive total dividends of $2 (i.e., $1 for each share) and sell the shares for $67.20 each. The dollar-weighted return on your investment is

Suppose you purchase one share of the stock of Cereal Correlation Company at the beginning of year 1 for

A. 10.00%.

B. 8.78%.

C. 19.71%.

D. 20.36%.

B. 8.78%.

You might also like to view...

The three major credit bureaus that can provide a copy of your report are:

a. Equifax, Experian, and Trans Union. b. Sears, J.C. Penney, and Costco c. Merrill Lynch, American Express, and McDonald Douglass d. Equifair, Expert, and Trans America e. Visa, MasterCard, and American Express

Validation answers the question "are we building the right product"?

Indicate whether the statement is true or false

Excerpts from Colter Corporation's most recent balance sheet appear below: Year 2Year 1Current assets: Cash$90 $120 Accounts receivable, net 100 110 Inventory 170 160 Prepaid expenses 40 40 Total current assets$ 400 $ 430 Total current liabilities$ 320 $ 290 Sales on account in Year 2 amounted to $1,210 and the cost of goods sold was $720.The working capital at the end of Year 2 is:

A. $80 B. $850 C. $770 D. $400

Based on the information above, the marketing critic and the marketing professional disagree about which of the following propositions?

A) Does private mortgage insurance guarantee that only financially prudent homebuyers will be able to buy homes? B) Is private mortgage insurance the best example in the housing industry of an unfair charge? C) Is private mortgage insurance required when the buyer pays at least 20 percent of the purchase price of a new home? D) Does private mortgage insurance provide value to homebuyers? E) Is private mortgage insurance the best way to insure lenders against loan risks?