Answer the following statements true (T) or false (F)

1. Earnings before interest, taxes, depreciation and amortization is lower than EBIT as long as the company has depreciation or amortization expenses.

2. For companies with very high interest expense, or very low EBIT, the interest expense limitation will reduce the tax advantage to issuing debt and the equation, K d (Cost of debt) = Y(1 ? T ), would need to be adjusted to reflect the impact of the new tax law.

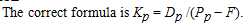

3. A firm's cost of preferred stock is equal to the preferred dividend divided by market price plus the dividend growth rate (Kp = D/P0 + g).

4. The cost of new common stock is greater than the cost of outstanding common stock.

5. In determining the cost of preferred stock, the earnings on outstanding preferred stock may be used as a proxy.

1. FALSE

2. TRUE

3. FALSE

4. TRUE

5. FALSE

You might also like to view...

Many consumers consider products with labels such as "Made in Bangladesh" and "Made in Brazil" to be of inferior quality and value

Indicate whether the statement is true or false

If the art museum is experiencing poor attendance because it has targeted senior citizens who are going to the area's natural history museum, the cause may be poor marketing competitive assessment at the level of

a. desire competition b. service form competitors c. generic competition d. enterprise competition e. all of the above

Why would issuers not be willing to pay for this incentive if they feel that interest rates will continue to decline?

What will be an ideal response?

Interest paid on outstanding bonds is usually paid

A. once every two years. B. once a year. C. semiannually, or every six months. D. quarterly, or every three months. E. on a monthly basis.