The default risk premium for U.S. corporate bonds was greater in the last 50 years of the 20th century than in the first decade of the 21st century

Indicate whether the statement is true or false.

Answer: FALSE

Explanation: about 0.47% vs 1.39%

You might also like to view...

Copra, a manufacturer of cigarettes, conducts a survey before launching its new range of herbal cigarettes. What is the basic purpose of undertaking such a survey by Copra?

What will be an ideal response?

The title "supplies" will appear as an expense on the income statement

Indicate whether the statement is true or false

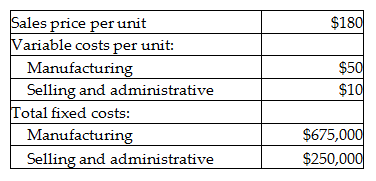

If a special pricing order is accepted for 5500 sails at a sales price of $150 per unit, and fixed costs remain unchanged, what is the change in operating income? (Assume the special pricing order will require variable manufacturing costs and variable selling and administrative costs.)

Voyage Sail Makers manufactures sails for sailboats. The company has the capacity to produce 37,000 sails per year and is currently producing and selling 30,000 sails per year. The following information relates to current production:

A) Operating income decreases by $825,000.

B) Operating income increases by $825,000.

C) Operating income decreases by $495,000.

D) Operating income increases by $495,000.

Regarding employee stock options, which of the following is/are true?

a. Firms compute a fair-value-based measure of employee stock options on the date of the grant using an option-pricing model that incorporates information about the current market price, the exercise price, the expected time between grant and exercise, the expected volatility of the stock, the expected dividends, and the risk-free interest rate. b. Total compensation cost is the number of options the firm expects to vest times the expected value per option at the date of redemption. c. Firms amortize this total cost over the requisite service period, which is the expected period of benefit. d. The requisite service period is usually the period between the grant date and the vesting date. e. Firms do not typically remeasure most types of stock options after the initial grant date.