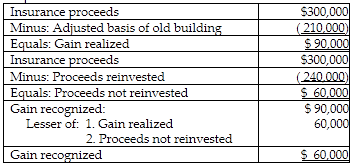

Ron's building, which was used in his business, was destroyed in a fire. Ron's adjusted basis in the building was $210,000, and its FMV was $330,000. Ron filed an insurance claim and was reimbursed $300,000. In that same year, Ron invested $240,000 of the insurance proceeds in another business building. Ron will recognize gain of

A) $0.

B) $30,000.

C) $60,000.

D) $90,000.

C) $60,000.

You might also like to view...

Gains/Losses arise from relatively infrequent transactions, and there can be no assurance that they will recur in any future period

Indicate whether the statement is true or false

An advantage to a retailer's using retailer-generated credit cards is _____

a. no bad debt b. low retailer startup costs c. the development of store loyalty d. rapid cash flow

Per capita means each heir gets an equal share of an estate

a. True b. False Indicate whether the statement is true or false

Everything else the same, if the yield curve is downward sloping, what is the yield to maturity on a 10-year Treasury coupon bond, relative to that on a one-year Treasury bond (T-bond)?

A. The yield on the 10-year bond is less than the yield on a one-year bond. B. The yield on a 10-year bond will always be higher than the yield on a one-year bond because of maturity premiums. C. It is impossible to tell without knowing the coupon rates of the bonds. D. The yields on the two bonds are equal. E. It is impossible to tell without knowing the relative risks of the two bonds.