What is the difference between the Treasury and the Federal Reserve? Is there any difference in the effect on the money supply between the sale of bonds by the Treasury and the sale of bonds by the Fed?

The Treasury and the Federal Reserve are two distinct agencies. The Treasury is responsible for the federal budget; if there is a budget deficit, the Treasury must sell bonds to the public to finance it. The Fed is responsible for the stability of the monetary and credit system for the country. It does not issue bonds to finance the federal government. When the Treasury sells bonds, there is no change in the money supply; money is just transferred from the private sector to the government sector. When the Fed sells bonds, the money supply increases because "new" money is going into circulation.

You might also like to view...

In the long run, with an increase in the plant size, _____

A. the short-run average total cost curve shifts downward B. the long-run average cost curve slopes downward C. the short-run average total cost curve shifts downward if economies of scale exist D. the average total cost of production rises

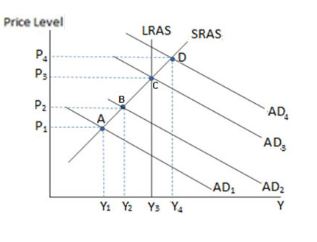

According to the graph shown, if the government decides to increase taxes, it is most likely at equilibrium:

A. A

B. B

C. C

D. D

Suppose a firm's short-run production function is given by Q = F(L) = 4L. If the wage rate is $12 and the firm has sunk costs of $300, then the firm's variable cost function is:

A. VC(Q) = $12Q. B. VC(L) = $3L. C. VC(Q) = $3Q. D. VC(Q) = $300 + $12Q.

Which of the following is not included in a nation's balance of payments?

a. Imports and exports of services. b. International interest and dividend earnings. c. International gifts. d. International loans. e. All of the above are included in the balance of payments.