In an attempt to bring lenders and borrowers together following the financial crisis of 2008, the Federal Reserve made a large amount of new funds available to financial markets. The Fed expected this to increase the money supply and the total amount of

lending because of the multiplier effect, in which a given amount of new reserves results in a multiple increase in

A) stockholders' equity.

B) bank deposits.

C) long-term debt.

D) required reserves.

Answer: B

You might also like to view...

For the federal deficit to be lowered,

A) the federal government must decrease its spending and increase net exports. B) the federal government's expenditures must be lower than its tax revenue. C) the Federal Reserve must reduce the money supply. D) the Federal Reserve must raise interest rates and lower the required reserve ratio.

Which of the following would increase the supply of childcare services?

a. An increase number of childcare facilities b. An increase in the cost of certification for workers in this field c. An increase in the price of childcare d. none of the above

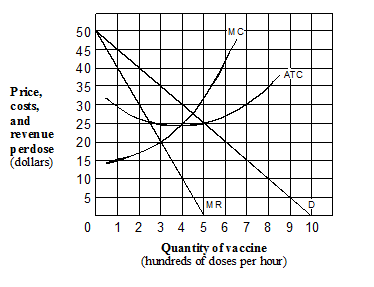

Exhibit 3 Demand and cost curves for GeneTech, a monopolist with a patented vaccine

A. $45 per dose and 100 doses per hour B. $40 per dose and 200 doses per hour C. $35 per dose and 300 doses per hour D. $28 per dose and 450 doses per hour

In the late 1990s, Thailand, Malaysia, and Indonesia all experienced sharp declines in the value of their currencies; this resulted in economic instability and crisis. The collapse in the values of their currencies undermined their development by:

A. decreasing political instability. B. decreasing population growth. C. increasing corruption. D. reducing investment.