Suppose the government of a town of 2,000 people implements a tax on each of 5 people in a small neighborhood to raise $1,000 for a sculpture that will be placed in the common area of that 5-person neighborhood

Each of the 5 people in the small neighborhood will receive $120 in benefits from the sculpture. This tax is likely to A) generate a great deal of opposition from taxpayers.

B) generate a great deal of opposition from the 5 people in the affected neighborhood.

C) generate little opposition from the 5 people in the affected neighborhood.

D) generate the desirable social outcome.

B

You might also like to view...

Macroeconomic equilibrium occurs when

A) there is no inflation. B) real GDP is equal to potential GDP. C) the aggregate quantity demanded is equal to the aggregate quantity supplied. D) the economy is fully employed. E) the price level equals the potential price level.

All food bought in the United States has an ingredient list on the packaging. This is an example of:

A. building a reputation. B. screening. C. requiring the more informed party to reveal missing information. D. signaling.

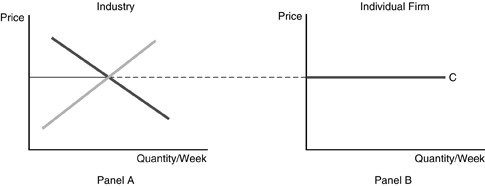

Refer to the above figure. Line C in Panel B does NOT represent

Refer to the above figure. Line C in Panel B does NOT represent

A. marginal revenue. B. total revenue. C. average revenue. D. the equilibrium price.

The consumer price index is computed by

A. the Bureau of Labor Statistics. B. Health and Human Services. C. the Bureau of Price Indexes. D. the White House Office of Management and Budget.