Redmond Company is considering investing in one of the following two projects:  (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required:1) Which project is more desirable strictly in terms of cash inflows? Why? 2) Compute the present value of each project's cash inflows assuming the company's required rate of return is 12%. 3) What is the maximum amount Redmond should be willing to pay for each project? 4) Suppose each project costs $7,000. Which project(s) should be accepted? Note that only one project can be accepted.

(PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required:1) Which project is more desirable strictly in terms of cash inflows? Why? 2) Compute the present value of each project's cash inflows assuming the company's required rate of return is 12%. 3) What is the maximum amount Redmond should be willing to pay for each project? 4) Suppose each project costs $7,000. Which project(s) should be accepted? Note that only one project can be accepted.

What will be an ideal response?

Answers will vary

1) Project B is more desirable because the majority of the cash flows occur earlier. The timing of the cash flows is important because of the concept of the time value of money which recognizes the fact that the present value of a dollar received in the future is worth less than a dollar.

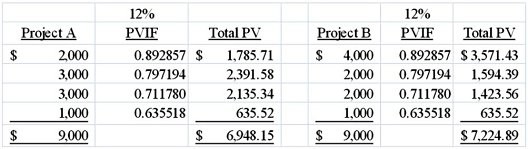

2) Present values:

3) Maximum that should be paid: Project A = $6,948.15; Project B = $7,224.90

4) Redmond should accept Project B because its NPV is positive (after subtracting the initial outflow of $7,000), while Project A's is negative (after subtracting the initial outflow of $7,000).

You might also like to view...

A credit crunch occurs when

A. banks do not lend as they ordinarily would, but rather have much higher requirements for borrowers to qualify for loans than normal. B. inflation rises, driving up interest rate near their legal ceiling, causing people to pull their funds out of banks. C. regulators pressure banks to increase loans to under-served groups in society. D. government officials force banks to lend in areas where they wish to establish branches.

The ability to scramble and code messages through keys that are shared only between the sender and receiver is referred to as _____.

A. encryption B. decryption C. transcription D. transmission

What is the service delivery system?

What will be an ideal response?

The price at which a stock can be sold depends upon a number of factors. Which statement below is not one of those factors?

A) the financial condition, earnings record, and dividend record of the corporation B) investor expectations of the corporation's earning power C) how high the par value D) general business and economic conditions and prospects