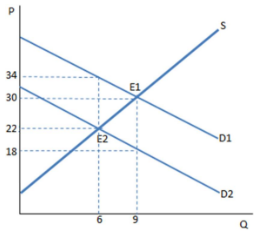

Suppose a tax on buyers has been imposed in the graph shown. Once the tax is in place, the sellers experience:

A. a decrease in supply.

B. an increase in supply.

C. a decrease in quantity supplied.

D. an increase in quantity supplied.

C. a decrease in quantity supplied.

You might also like to view...

How are the wage rate and employment determined in a competitive labor market?

What will be an ideal response?

The spending multiplier also applies to investment spending by businesses

a. True b. False Indicate whether the statement is true or false

A free good is different from a scarce good because it is:

A) not tradable. B) not produced. C) not scarce. D) found only in nature.

Which of the following causes a leftward shift in the short-run aggregate supply curve?

A. An increase of goods prices while nominal incomes are unchanged. B. An increase in nominal incomes. C. An increase of full-employment real GDP. D. An increase of personal consumption expenditures while the price level is unchanged.