Fried Food, Inc, operates a commercial frying plant, discharging pol¬lut¬ants into the air. Greg reports the violations to the Environmental Protection Agency. Greg

a. is not entitled to a payment.

b. may be paid up to any amount.

c. may be paid up to $1,000.

d. may be paid up to $10,000.

D

You might also like to view...

Asset turnover ratio

a. Market price per share b. Net sales c. Gross profit d. Average total assets e. Interest expense, net of tax f. Net income g. Total liabilities h. Total assets

Somerdale Corp. received an order from a customer on November 10. It manufactured the ordered items on November 15, shipped the goods on November 17, and received payment on December 2. Under the accrual basis of accounting, Somerdale should record revenue on:

A. November 17. B. November 10. C. November 15. D. December 2.

Dan purchases a 25% interest in the Haymarket Partnership for $20,000 on January 1, and begins to materially participate in the partnership's business. The Haymarket Partnership uses the calendar year as its tax year. At the time of the purchase, the Haymarket Partnership has $2,000 in liabilities, and Dan's share is 25%. During the year, the Haymarket Partnership incurs $100,000 in losses and

its liabilities increase by $4000. What is Dan's basis in his partnership interest on December 31? What will be an ideal response?

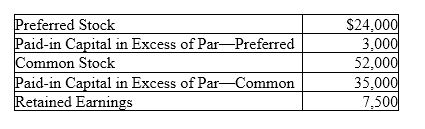

NW Stone Supply's Stockholders' Equity section includes the following information:

Total paid-in capital is:

A) $76,000.

B) $121,500.

C) $114,000.

D) $38,000.