The graphs above show the production possibilities curves for the U.S. and Canada, which both produce cars and wheat. Determine comparative advantage for each country, and then draw the CPC for each country, assuming that the world price of cars is 1.5 wheat. (Assume that wheat is measured in thousands of bushels.) How would the gains from trade change if the price of cars rose to 1.75 wheat?

What will be an ideal response?

In the U.S., the opportunity cost of a car is 1 wheat. The opportunity cost of wheat is 1 car. In Canada, the opportunity cost of a car is 2 wheat. The opportunity cost of wheat is 1/2 car. The U.S. has a comparative advantage in cars, and likewise, Canada has a comparative advantage in wheat. With trade, the U.S. CPC begins at the horizontal intercept and has a slope of -1.5. The Canadian CPC begins at the vertical intercept and has a slope of -1.5. A rise in the price of cars rotates the Canadian CPC inward and the U.S. CPC outward. The gains from trade increase in the U.S. and decrease in Canada.

You might also like to view...

The long-run average cost curve shows the lowest possible average cost for each output level, given that all inputs are variable.

Answer the following statement true (T) or false (F)

Technological change that increases the marginal productivity of labor in the classical model would cause

a. labor demand, output and the price level to rise. b. labor demand to fall, the price level to fall, and output to rise. d. labor demand, output and employment to rise. c. output to rise but labor demand to fall.

An expenditure schedule that lies below the full employment level of GDP will cause

a. rising prices. b. increasing output. c. falling inventories. d. falling prices.

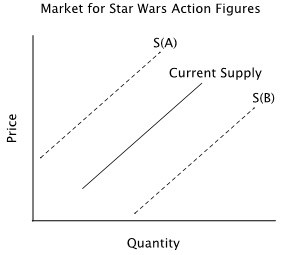

Refer to the accompanying figure. Suppose the solid line represents the current supply of Star Wars action figures. If retailers learn that a new Star Wars movie will be released in several months, this news is likely to cause:

A. a decrease in the quantity supplied, but no change in current supply. B. current supply to shift to S(B) in anticipation of higher future prices. C. neither a change in supply nor a change in quantity supplied since only future demand will change. D. current supply to shift to S(A) in anticipation of higher future prices.