Explain how a bilateral monopoly equilibrium outcome differs from a purely competitive outcome.

What will be an ideal response?

In pure competition, there are so many sellers and buyers that each is too small to affect the price and quantity of the product. However, in the case of bilateral monopoly, the size of the parties matters. Neither is likely to passively accept the price or quantity as given, and each is likely to actively pursue goals and adopt strategies to attain these goals. Therefore, the outcome of bilateral monopoly cannot be predicted in advance unless the goals of the parties are clearly specified. In general terms, most economists suggest that the presence of a union forces employers to pay higher wages than otherwise and perhaps induce the firm to increase employment above what it might otherwise choose.

You might also like to view...

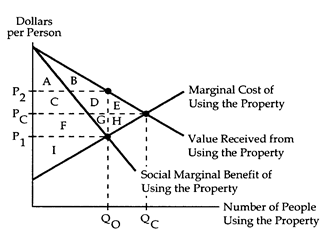

Refer to Common Property II. If access cannot be prohibited, then users of the common property receive a surplus of

The following questions refer to the accompanying diagram, which shows the benefits and costs associated with the use of a common property.

a. zero.

b. area I.

c. area F + G + H + I.

d. area A + C + F + I.

The statement “Resources employed in producing X are better suited to making Y” is another way of saying

A. the production possibilities frontier is “bowed out.” B. the production possibilities frontier is a straight line. C. the production possibilities frontier is “bowed in.” D. resources are unproductive. E. resources have no opportunity cost.

In the market for reserves, if the federal funds rate is above the interest rate paid on excess reserves, an open market purchase ________ the ________ of reserves which causes the federal funds rate to fall, everything else held constant

A) increases; supply B) increases; demand C) decreases; supply D) decreases; demand

John derives more utility from having $1,000 than from having $100. From this, we can conclude that John

A) is risk averse. B) is risk loving. C) is risk neutral. D) has a positive marginal utility of wealth.