We saw in the text that regulations, specifically deposit insurance and the base Accord (of 1988), can create moral hazard. Explain.

What will be an ideal response?

Deposit insurance creates moral hazard for bank managers. Knowing that any gains from risky assets will go to owners but any losses will be covered by the insurance fund, managers have an incentive to take on added risk. Similarly, with the 1988 (first) Basel Accord, the system that was developed failed to distinguish among assets with different default risks (such as the Treasury bonds of the United States and bonds of emerging-market countries like Turkey). This gave banks an incentive to shift their holdings toward riskier assets in ways that did not increase their required bank capital.

You might also like to view...

The difference between M1 and M2 is significant. Which of the following best describes the difference? a. M1 is nearly three times as large as M2

b. M2 is made up mostly of demand and checkable deposits. c. M2 is substantially larger than M1. d. None of the above.

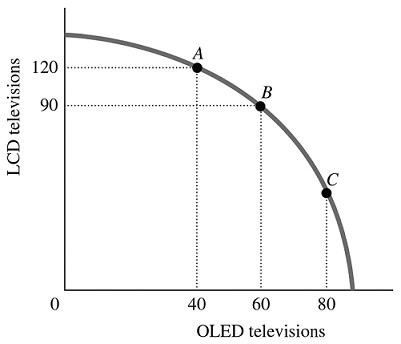

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point A. The opportunity cost of moving from Point A to Point B is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point A. The opportunity cost of moving from Point A to Point B is the

A. 30 LCD televisions that must be forgone to produce 60 additional OLED televisions. B. 90 LCD televisions that must be forgone to produce 20 additional OLED televisions. C. 30 LCD televisions that must be forgone to produce 20 additional OLED televisions. D. 120 LCD televisions that must be forgone to produce 40 additional OLED televisions.

A tax whose burden is the same proportion of income for all households is

A. an equal tax. B. a regressive tax. C. a proportional tax. D. a progressive tax.

Of the following countries, which has the lowest level of income inequality?

A. Greece B. Japan C. Mexico D. Slovenia