Banks help to overcome the problem of asymmetric information by:

a. lending to a single rich borrower and not diversifying their portfolio.

b. acquiring expertise in evaluating the credit histories of borrowers.

c. threatening borrowers

d. offering only one type of loan.

e. providing information to lenders.

b

You might also like to view...

Assume that the central bank purchases government securities in the open market. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and reserves account in the context of the Three-Sector-Model?

a. The real risk-free interest rate falls, and reserves account becomes more negative (or less positive). b. The real risk-free interest rate falls, and reserves account becomes more negative (or less positive). c. The real risk-free interest rate falls, and reserves account remain the same. d. The real risk-free interest rate rises, and reserves account remains the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

Which of the following would a permanent increase in the growth rate of the money supply change permanently?

a. inflation b. unemployment c. both inflation and unemployment d. neither inflation nor unemployment

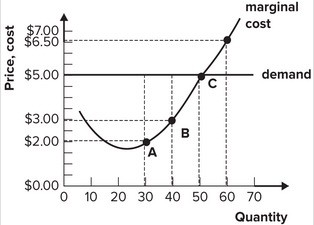

Refer to the graph shown. The marginal cost of producing the 60th unit is:

A. $6.50. B. $3.50. C. $3.00. D. $5.00.

A mortgage-backed security (MBS) is a type of bond whose interest payments and principal repayments derive from the monthly mortgage payments of many households.

Answer the following statement true (T) or false (F)