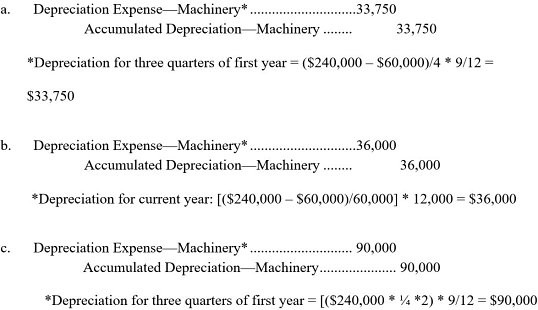

On April 1 of the current year, a company purchased and placed in service a machine with a cost of $240,000. The company estimated the machine's useful life to be four years or 60,000 units of output with an estimated salvage value of $60,000. During the current year, 12,000 units were produced. Prepare the necessary December 31 adjusting journal entry to record depreciation for the current year assuming the company uses:a. The straight-line method of depreciationb. The units-of-production method of depreciationc. The double-declining balance method of depreciation

What will be an ideal response?

You might also like to view...

Discuss the three major provisions of the Fair Labor Standards Act (FLSA).

What will be an ideal response?

Childers Company, which uses a perpetual inventory system, has an established petty cash fund in the amount of $400. The fund was last reimbursed on November 30. At the end of December, the fund contained the following petty cash receipts: December 4Freight charge for merchandise purchased$62December 7Delivery charge for shipping to customer$46December 12Purchase of office supplies$30December 18Donation to charitable organization$51If, in addition to these receipts, the petty cash fund contains $201 of cash, the journal entry to reimburse the fund on December 31 will include:

A. A debit to Transportation-In of $62. B. A debit to Petty Cash of $189. C. A credit to Office Supplies of $30. D. A credit to Cash of $199. E. A credit to Cash Over and Short of $10.

The statement of cash flow explains the changes that took place in the firm's cash balance over the

period of interest. Indicate whether the statement is true or false

Edward Seaton owns a firm that manufactures custom-made carpets. He has a regular sales force to call on smaller customers and an elite force to call on larger accounts. The elite sales force is called

A. supporting salespeople. B. a major accounts sales force. C. customer service reps. D. missionary salespeople. E. technical specialists.