A tax cut intended to increase aggregate demand is an example of

A. Fiscal stimulus.

B. Fiscal restraint.

C. Fiscal targeting.

D. Monetary restraint.

Answer: A

You might also like to view...

A friend tells you he is studying the incidence of the corporate income tax. What is the subject of his study?

A) how frequently corporations should be taxed B) how inflation affects the amount of tax revenue collected from firms C) how corporations can aid the government in collecting delinquent taxes D) how the burden of corporate taxation is distributed among stockholders, employees, and consumers

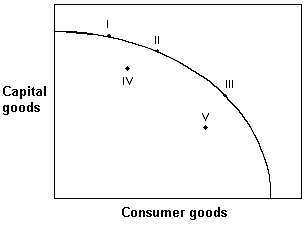

Exhibit 17-1 Nation of Padia

A. a move from V to III B. a move from IV to II C. a move from III to a point beyond the production possibilities curve D. a move from III to I

Recall the Application about Rory McIlroy and weed-whacking to answer the following question(s). The Application assumes that Rory McIlroy could whack down all the weeds on his estate in one hour at an opportunity cost of $1,000, but it would take 20 hours for a gardener to do it at a price of $10 per hour.This Application addresses the economic concept of:

A. the marginal principle. B. diminishing returns. C. specialization and exchange. D. real versus nominal costs.

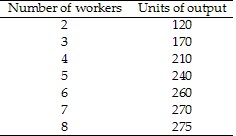

Refer to Table 17.2. If the price of output is $2 per unit and we observe the firm hiring four workers, if the firm is maximizing profit, the wage rate must be between ________ and ________.

Refer to Table 17.2. If the price of output is $2 per unit and we observe the firm hiring four workers, if the firm is maximizing profit, the wage rate must be between ________ and ________.

A. $25; $45 B. $30; $35 C. $45; $60 D. $60; $80