Increasing productivity per person:

A. is highly desirable, as it leads to economic growth.

B. is unavoidable, and macroeconomists work to prevent it.

C. can harm an economy if misallocated.

D. is highly undesirable, as it leads to increases in GDP per capita.

A. is highly desirable, as it leads to economic growth.

You might also like to view...

What would an economist point to explain why there are no large farms within Detroit city limits?

A) The cultural characteristics of the typical Detroit citizen B) The political power of the automobile industry in Detroit C) The residential and commercial demand for real estate in Detroit D) None of the above.

Refer to Figure 18-2. If the government imposes an excise tax of $1.00 on every unit sold

A) the deadweight loss is greater under the supply curve S0. B) the deadweight loss is greater under the supply curve S1. C) the deadweight loss is identical under either supply curve. D) there is no deadweight loss since revenue raised is used to fund government projects.

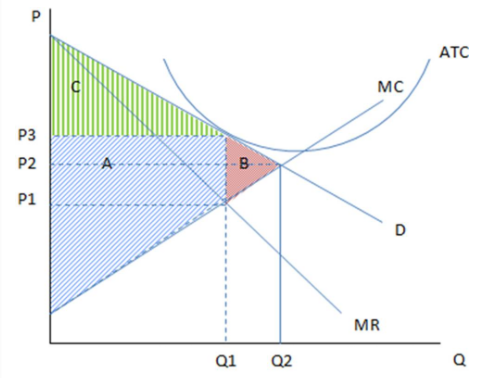

Assuming the firm in the graph is producing Q1 and charging P3, it is likely:

These are the cost and revenue curves associated with a firm.

A. in long-run equilibrium.

B. an efficient outcome.

C. not maximizing profits.

D. operating at a loss.

Suppose the United States decides to impose a $1,000 tax on every Japanese minivan sold in the United States. This is an example of:

a. a tariff. b. free trade. c. comparative advantage. d. the diversity of industry argument. e. a quota.