Which of the following outcomes is NOT a result of a tax imposed on sellers of gasoline?

A) Supply decreases, a deadweight loss is created, and the price rises.

B) The market becomes less efficient and the government collects the tax revenue.

C) Demand does not change, the price rises, and consumer surplus decreases.

D) Demand decreases, the market becomes more efficient, and the price rises.

D

You might also like to view...

If a Japanese importer could buy $1,000 U.S. for 122,000 yen, the rate of exchange for one dollar would be ________.

A. 1,220 yen B. 122 yen C. 820 yen D. 8.19 yen

The bid-asked spread is likely to be greater on securities that are

A) issued in larger denominations. B) have low market risk. C) less liquid. D) traded in a deep market.

The largest component of the money supply (M1 ) is

A) time deposits. B) large CDs. C) demand deposits. D) coin and currency.

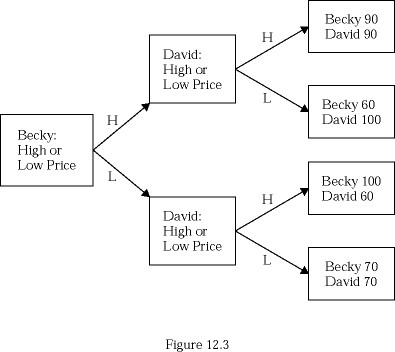

Consider Figure 12.3. Relative to the dominant strategy outcome, guaranteed price fixing would lead to:

Consider Figure 12.3. Relative to the dominant strategy outcome, guaranteed price fixing would lead to:

A. lower prices but higher profits. B. lower prices and lower profits. C. higher prices and higher profits. D. higher prices and lower profits.