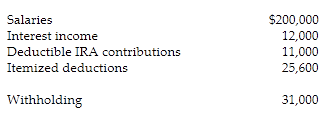

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2018. Both Bob and Brenda are age 32 and have no dependents.

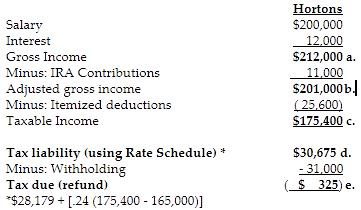

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax), rounded to the nearest dollar?

e. What is the amount of their tax due or (refund due)?

You might also like to view...

The accounting system used with JIT manufacturing is called:

a. Backflush costing. b. The push system. c. Perpetual inventory costing. d. First-in, first-out.

If an estimate for an activity is deterministic, then ______.

A. sufficient historical information is available to make this determination with a reasonable degree of accuracy B. the estimate is based on the probability that the activity will be completed in a given time frame C. the estimate is based on the probability that the activity will be completed in a given time frame plus/minus three standard deviations D. the estimate is based on a stochastic model

Complete the following table to indicate your understanding of fixed and variable cost behavior by inserting one of the following responses in each box: "Remain constant," "Increase," or "Decrease."?When Activity IncreasesWhen Activity DecreasesUnit fixed costs??Total fixed costs??Unit variable costs??Total variable costs??

What will be an ideal response?

A disclaimer of opinion is a clause in auditing that a company can claim wherein the auditor is not allowed to access a high-priority portion of a company's financial records

Indicate whether the statement is true or false