Exporting refers to a global market-entry strategy

A. in which a company will sell its products in international markets but not in its own domestic market.

B. in which a company will manufacture products specifically designed for non-domestic markets, but will sell those products to distributors who take title and resell the products to different companies around the world.

C. in which a company will manufacture its product in several countries at the same time using different brand names and slight product modifications.

D. in which a company produces goods in one country and sells them in another country.

E. whereby a product is made in one country, assembled in a second country, and ultimately marketed to a third country.

Answer: D

You might also like to view...

Discuss the documents used in a batch processing system

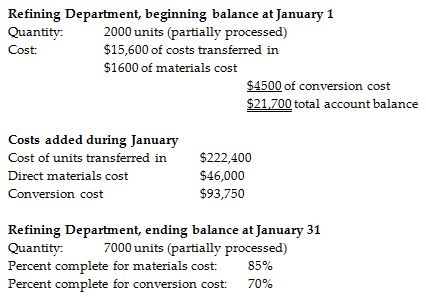

Thomas Manufacturing produces a chemical pesticide and uses process costing. There are three processing departments—Mixing, Refining, and Packaging. On January 1, the Refining Department had 2000 gallons of partially processed product in production. During January, 36,000 gallons were transferred in from the Mixing Department, and 31,000 gallons were completed and transferred out. At the end of the month, there were 7000 gallons of partially processed product remaining in the Refining Department. See additional details below

What was the cost per equivalent unit with respect to direct materials costs for the Refining Department in the month of January? Use the weighted-average method. (Round your calculations to the nearest cent.)

A) $1.29

B) $2.74

C) $1.25

D) $6.80

What is the primary target market for a best-cost provider?

A. value-conscious buyers B. value-hunting buyers C. brand-conscious buyer D. price-conscious buyers E. best-price driven buyers

The accounting rate of return is calculated as:

A. The annual cash flows divided by the annual average investment. B. The annual cash flows divided by the total investment. C. The annual average investment divided by the after-tax income. D. The annual after-tax income divided by the annual average investment. E. The annual after-tax income divided by the total investment.