The Laffer Curve indicates that

a. when tax rates are high, a rate reduction may lead to an increase in tax revenue.

b. when tax rates are low, an increase in tax rates will generally lead to a reduction in tax revenues.

c. an increase in tax rates will always lead to an increase in tax revenues.

d. the deadweight losses resulting from taxation are small at the tax rate that maximizes the revenues derived by the government.

A

You might also like to view...

The table gives information about the economy of Japan. The economic growth rate in 1997 is ________ percent

A) 8.0 B) 0.8 C) 0.08 D) 0.008 E) 4

One of the primary objections to the new classical model is that ________

A) firms could easily get information about price movements and so would not be fooled for very long B) price is negatively related to quantity demanded, but positively related to quantity supplied C) business cycles are relatively brief in duration D) it failed to incorporate rational expectations into its presentation

A major criticism of static tax analysis is that it

A) uses only ad valorem taxes. B) does not use ad valorem taxes. C) ignores the incentive effects created by higher tax rates. D) assumes that the tax base will not increase.

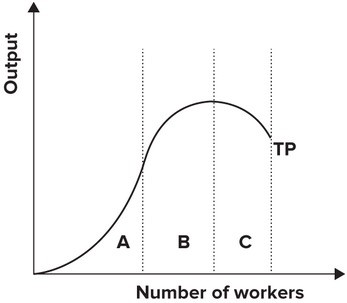

Refer to the graph shown. Within which part of the production function is the firm most likely to operate?

A. A B. B C. C D. B and C