On September 1, 2012, Al buys a bond for $15,000 that makes coupon payments of $750 after each of the following three years and returns its principal of $15,000 at the end of the three years. In other words, it is a standard coupon bond with a 5 percent annual interest rate making payments once each year.On September 1, 2013, Al receives his first coupon payment of $750. At that time, the market interest rate on bonds like Al's has risen to 6 percent. Al sells his bond to Biff at that time, for a price equal to the present value of the bond's payments.

a.How much does Biff pay Al for the bond?

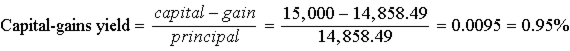

b.Calculate Al's current yield, capital-gains yield, and total return for the year.On September 1, 2014, Biff receives a coupon payment of $750. The market interest rate on bonds like his remains 6 percent. Biff sells his bond to Cass at that time, for a price equal to the present value of the bond's payments.

c.How much does Cass pay Biff for the bond?

d.Calculate Biff's current yield, capital-gains yield, and total return for the year.On September 1, 2015, Cass receives a coupon payment of $750 and the principal of $15,000. Over the course of the year (between September 1, 2014, and September 1, 2015), the market interest rate on bonds like his rose to 7 percent. But Cass decided to keep the bond.

e.What is Cass's total return for the year?Explain and show all your work for each part.

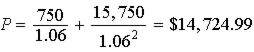

| a. |  |

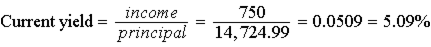

| b. |  |

| |

| Total return = current yield + capital-gains yield = 5% ? 1.83% = 3.17% | |

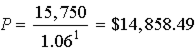

| c. |  |

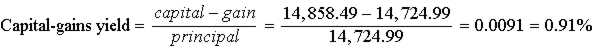

| d. |  |

| |

| Total return = current yield + capital-gains yield = 5.09% + 0.91% = 6% | |

| You should expect this because Biff bought the bond at a yield to maturity of 6 percent and held it for a year, and the market interest rate did not change. | |

| e. | Six percent, since Cass bought it when the yield to maturity was 6 percent and held it until it matured. |

| You could also do this one the hard way: | |

| |

| |

| Total return = current yield + capital-gains yield = 5.05% + 0.95% = 6% |

You might also like to view...

Dechter Company acquired a mine for $1,800,000 which has an estimated residual value of $300,000 and contains an estimated 1,500,000 tons of coal. If 230,000 tons of coal are mined and sold during the first year, the entry to record the depletion charge is:

A) Accumulated Depletion-Coal Deposits 230,000 Depletion Expense-Coal Deposits 230,000 B) Accumulated Depreciation-Asset 276,000 Asset 276,000 C) Depletion Expense-Coal Deposits 230,000 Accumulated Depletion-Coal Deposits 230,000 D) Accumulated Depletion-Coal Deposits 230,000 Coal Deposits 230,000

Cash flows from investing activities are determined by:

a. explaining the changes in each account involving cash payments and cash receipts from investing activities. b. analyzing each item on the income statement. c. analyzing the stockholders' equity accounts on the balance sheet. d. all of these are correct.

When conducting a training-needs assessment, Lako Systems found that a more flexible set of competencies is needed for performance. This finding would have occurred in the task analysis step of the assessment.

Answer the following statement true (T) or false (F)

The beginning inventory costs and the product costs of the current period are combined to determine the average cost of equivalent units of production under the ________

A) equivalent units method B) conversion costs method C) first-in, first-out method D) weighted-average method