The benefits-received principle of taxation is most evident in:

a. progressive tax rates.

b. excise taxes on gasoline.

c. the personal income tax.

d. the corporate income tax.

b

You might also like to view...

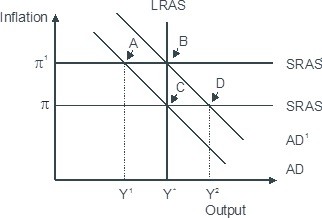

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

Identify at least three key factors in the HPAE's economic success?

What will be an ideal response?

Keynes hypothesized that the precautionary component of money demand was primarily determined by the level of

A) interest rates. B) velocity. C) income. D) stock market prices.

The excess burden of a tax is:

a. the amount by which the price of a good increases. b. the loss of consumer and producer surplus that is not transferred to the government. c. the amount by which a person's after-tax income decreases as a result of the new tax. d. the welfare costs to firms forced to leave the market due to an inward shift of the demand curve.