Tax preferences create more _____ than a broad-based income tax because they change the relative prices to the taxpayer of earning different types of income

a. welfare loss

b. benefits

c. taxable income

d. tax avoidance

a

You might also like to view...

Last year, in a nation far to the South, real GDP was $90 million and 900,000 workers were employed. This year real GDP is $100 million, 950,000 workers are employed, and the number of hours each worker works per year did not change

Hence, labor productivity A) has decreased. B) has increased. C) has remained constant. D) cannot be compared between the two years because both real GDP and the number of workers increased. E) might have changed, but more information is needed to determine if it changed.

Suppose the federal government makes it mandatory for employers to provide health insurance to all employees. Assuming the new mandate applies to homebuilders, the

A) demand for construction workers is likely to increase. B) supply of new homes is likely to increase. C) supply of new homes is likely to decrease. D) supply of new homes will remain the same; businesses will simply "pass" the higher costs on to consumers.

All of the following costs are included in the calculation of accounting profit, except

a. Interest payments on borrowed funds b. Costs paid to suppliers for product ingredients c. Opportunity cost of capital d. Depreciation expenses related to investments in buildings and equipment

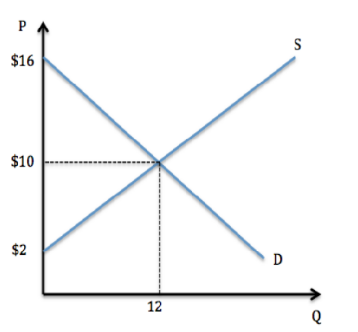

According to the graph shown, consumer surplus is:

A. $36.

B. $72.

C. $120

D. None of these.