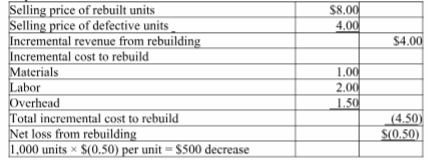

A company has the choice of either selling 1,000 defective units as scrap or rebuilding them. The company could sell the defective units as they are for $4.00 per unit. Alternatively, it could rebuild them with incremental costs of $1.00 per unit for materials, $2.00 per unit for labor, and $1.50 per unit for overhead, and then sell the rebuilt units for $8.00 each. If the company rebuilds the units, what is the impact on income?

A) Income will increase by $4,000.

B) Income will increase by $500.

C) Income will decrease by $4,500.

D) Income will decrease by $500.

E) Income will increase by $8,000.

D) Income will decrease by $500.

You might also like to view...

On March 15, 2018, Blue Corporation purchased 10% of the Gold Corporation stock outstanding. Blue Corporation purchased an additional 40% of the stock in Gold on October 24, 2018, and an additional 25% on April 4, 2019. On July 25, 2019, Blue Corporation purchased the remaining 25% of Gold Corporation stock outstanding. a.For purposes of the § 338 election, on what date does a qualified stock purchase occur? b.What is the due date for making the § 338 election?

What will be an ideal response?

The final stage in the product life cycle is ________

A) maturity B) decline C) phasing out D) harvesting E) divestment

A retail firm has net annual sales of $6,000,000 . Its average monthly inventory at hand (at retail) was $1,500,000 . Its annual rate of stock turnover is _____

a. 0.25 b. 3.0 c. 3.5 d. 4.0

A drawback of Gantt charts is ______.

a. they may not show the exact sequencing of one activity to another b. they are complex to develop c. they are time-consuming to develop d. they are expensive to develop