Describe Keynes' criticism of Say's law in a money economy

In order for Say's law to hold in a money economy, any decrease in saving would have to be offset by an equal increase in investment. According to the Classical economists, this would happen through changes in interest rates. Keynes disagreed with this view and pointed out that added saving would not necessarily lead to an equal amount of added investment. Keynes asserted that people save and invest for a variety of reasons, and not on one single variable such as interest rates. According to Keynes, saving is more responsive to changes in income than to changes in the interest rate, and investment is more responsive to change in technology and business expectations than to changes in interest rate.

You might also like to view...

Refer to Figure 2-10. If the economy is currently producing at point D, what is the opportunity cost of moving to point B?

A) 16 thousand spoons B) 46 thousand forks C) 0 forks D) 60 thousand spoons

Flexible, or floating, exchange rate is determined by the:

A. World Bank. B. forces of supply and demand. C. price of gold. D. Federal Reserve.

Which market model has the least number of firms?

A. Pure monopoly B. Pure competition C. Oligopoly D. Monopolistic competition

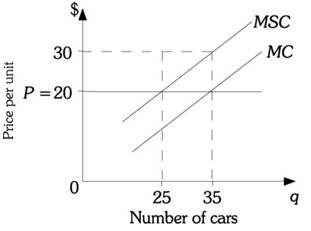

Refer to the information provided in Figure 16.2 below to answer the question(s) that follow. Figure 16.2Refer to Figure 16.2. What is the total damage imposed as a result of producing the efficient level of cars?

Figure 16.2Refer to Figure 16.2. What is the total damage imposed as a result of producing the efficient level of cars?

A. $0 B. $250 C. $350 D. $500