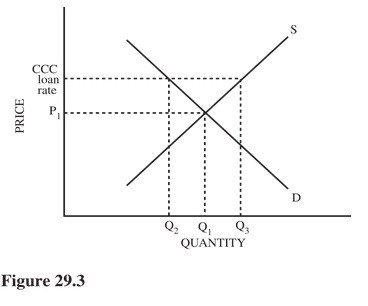

Refer to Figure 29.3 for a cotton market with an equilibrium price of P1 and a Commodity Credit Corporation (CCC) loan rate set above P1. Given this situation, cotton farmers are most likely to

Refer to Figure 29.3 for a cotton market with an equilibrium price of P1 and a Commodity Credit Corporation (CCC) loan rate set above P1. Given this situation, cotton farmers are most likely to

A. Sell their cotton on the market and repay only a portion of the CCC loan.

B. Leave the cotton farming business.

C. Sell their cotton on the market and repay the CCC loan with the proceeds plus other funds to make up the difference.

D. Give their cotton to the CCC and not repay the loan.

Answer: D

You might also like to view...

What is the relationship between the government's budget deficit and its tax revenue?

a. Budget deficit = government spending + tax revenue b. Budget deficit = government spending - tax revenue c. Government spending = budget deficit / tax revenue d. Tax revenue = government spending + budget deficit e. Budget deficit = tax revenue - government spending

If workers become more productive as a result of a new technology, the demand for these workers will decrease because the firm will not need to hire as many

Indicate whether the statement is true or false

If the U.S. enjoys an absolute advantage in agriculture compared to every other country in the world, then

A. agricultural production will take place only in the U.S. B. the U.S. necessarily has a comparative advantage in agriculture. C. the U.S. may or may not have a comparative advantage in agriculture. D. the U.S. necessarily does not have a comparative advantage in agriculture.

A liquidity trap occurs when:

A. a bank is short of reserves and must stop making new loans. B. the money multiplier falls enough to offset the effect of increases in reserves. C. the interest rate is below the inflation rate. D. the Fed buys reserves from banks, driving up the interest rate.