In 2007 the total amount of tax collection the federal government brought to the Treasury from all sources was $2.7 Trillion. The population of the U.S. is about 300 million

Assume that all forms of government taxation were abolished and each citizen was required to pay exactly the same as everyone else. What would be the tax burden in dollar terms on each citizen (man, women and child)? How would you characterize a tax system like this? Who would likely protest the most? Who would benefit the most? If the new tax was not repealed, what changes do you believe would take place in the government's budget?

This would amount to a tax bill per person of $9,000 per year per person. This would clearly be characterized as a regressive tax. As incomes rise the average tax rate would fall. Those earning the lowest income or those unemployed would protest the most. Higher income earners would no doubt benefit the most. If the tax were not repealed it seems plausible that government expenditures would be cut drastically since many people at the lower income levels would simply not be able to pay their taxes. If Congress decides not to cut spending it would either have to borrow the money or the Federal Reserve would have to expand the money supply.

You might also like to view...

The IT industry in Techland has a Herfindahl-Hirschman Index of 1,320. This implies that the IT industry in Techland is ________

A) not concentrated B) moderately concentrated C) highly concentrated D) dominated by a few large buyers

A primary difference between rebates and coupons?

A) Coupons allow individuals to sort themselves into the high-elasticity group after the sale. B) Neither coupons or rebates are redeemed in high numbers. C) Rebates allow individuals to sort themselves into the high-elasticity group after the sale. D) Coupons are legal and rebates are illegal.

The acronym NAVPS in the mutual fund table denotes:

a. the percentage change in the asset value of the mutual fund from the close of the previous day's trading. b. the highest and lowest values that the mutual fund has experienced over the last one year. c. the highest asset value at which the fund was sold during the past week. d. the percentage change in the asset value of the mutual fund from the previous week. e. the value of the mutual fund divided by the number of shares of the fund.

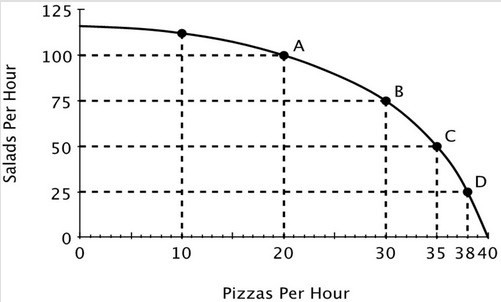

Refer to the accompanying figure. The opportunity cost of making an additional salad:

A. decreases as the number of salads increases. B. increases as the number of salads increases. C. decreases as the number of pizzas decreases. D. remains constant regardless of how many salads are made.