Determine the tax rate. Round to the nearest cent or nearest hundredth.Assessed property value: $137,400,000Expenses to be funded by property tax: $5,104,000Tax per amount of assessed value: $1

A. $0.04 per $1

B. $0.27 per $1

C. $0.31 per $1

D. $0.03 per $1

Answer: A

You might also like to view...

Find all the first order partial derivatives for the following function.f(x, y) =

A.  =

=  ;

;  =

=

B.  = -

= -  ;

;  = -

= -

C.  = -

= -  ;

;  = -

= -

D.  = -

= -  ;

;  = -

= -

Find the vertex, focus, and directrix of the parabola.-  x2 = y

x2 = y

A. Vertex: V(0, 0); focus: F(0, 8); directrix: y = -8 B. Vertex: V(0, 0); focus: F(0, -8); directrix: y = -8 C. Vertex: V(0, 0); focus: F(0, -8); directrix: y = 8 D. Vertex: V(0, 0); focus: F(-16, 0); directrix: x = 8

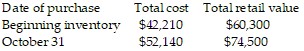

Solve the problem using the information given in the table and the retail inventory method. Round dollar amounts to the nearest cent.Find the cost ratio, rounded to the nearest hundredth.

A. 1.43 B. 0.86 C. 0.07 D. 0.70

Add or subtract. Express the answer as a mixed number.17 - 9

- 9

A. 7

B. 7

C. 6

D. 8