Local property taxes are a

A. Progressive tax because the total tax on housing increases as the price of the house increases.

B. Progressive tax because as income increases people tend to buy more expensive houses.

C. Regressive tax because poorer people spend a larger portion of their income on property taxes.

D. Proportional tax because properties are taxed at the same rate regardless of the value of the home.

Answer: C

You might also like to view...

Open market operations are defined as

A) a bank borrowing from the Fed. B) the buying and selling of securities by the Fed. C) the buying and selling of securities between banks. D) the amount banks can lend on each deposit. E) a bank making a loan to the Fed.

Plato and Aristotle were both concerned about how an unequal distribution of income could cause political instability

Indicate whether the statement is true or false

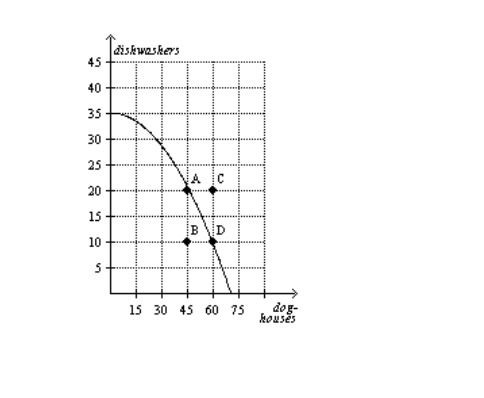

Refer to Figure 2-14. Unemployment could cause this economy to produce at point B.

Indicate whether the statement is true or false.

A monopolistically competitive market is one in which:

A. only one firm sells a product. B. all firms sell an identical product. C. many firms sell similar yet slightly different products. D. firms have no control over the price they charge for their product.