If we want to gauge how much the income tax system distorts incentives, we should use the

a. average tax rate.

b. ability-to-pay principle.

c. total tax revenue collected.

d. marginal tax rate.

d

You might also like to view...

Monitoring the performance of the people managing the firm is easiest in the case of

A) proprietorships. B) partnerships. C) corporations. D) S corporations.

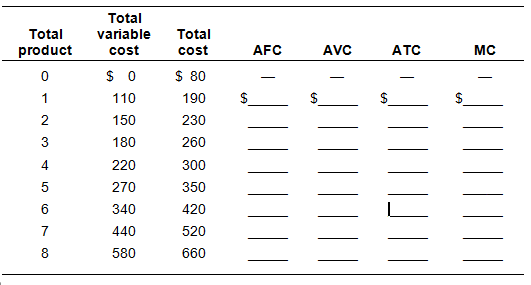

Assume a firm has fixed costs of $80 and variable costs as indicated in the table below. Complete the cost table

Recall the Application about the free-agent market for professional baseball pitchers to answer the following question(s).Recall the Application. Why is there adverse selection in the baseball pitcher free-agent market?

What will be an ideal response?

If other factors are held constant, an increase in the price level

A. induces people to spend their money faster. B. causes the real value of the money to increase. C. causes desired net export spending to rise. D. causes desired net export spending to fall.