Answer the next question on the basis of the following four tax schedules for the given base of taxable income. IncomeTax ATax BTax CTax D$10,000$650$1,000$500$1,00020,0008502,0001,0003,00030,0009504,0001,5006,00040,0001,0506,0002,0009,500Which of the above tax schedules is a progressive tax schedule throughout?

A. Tax A

B. Tax B

C. Tax C

D. Tax D

Answer: D

You might also like to view...

Suppose real GDP is currently $12.5 trillion and potential real GDP is $13 trillion. If the president and Congress increased government purchases by $500 billion, what would be the result on the economy?

What will be an ideal response?

The U.S. government currently imposes a $0.54 per gallon tariff on all ethanol imported into the country. If this tariff were removed, then:

A) the domestic ethanol price falls. B) the domestic quantity of ethanol supplied declines. C) domestic consumer surplus increases. D) domestic producer surplus decreases. E) all of the above

Which of the following is not true for a monopoly?

A.) The demand curve for the monopoly and the market are the same. B.) It has no direct competitors. C.) It can use its market power to charge higher prices than a competitive firm. D.) It is a price taker.

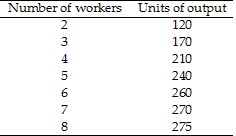

Refer to Table 17.2. The marginal product of the fifth unit of labor is:

Refer to Table 17.2. The marginal product of the fifth unit of labor is:

A. 50. B. 40. C. 30. D. 20.