The largest share of federal government tax receipts is derived from

A) corporate income taxes.

B) excise taxes.

C) social insurance contributions.

D) individual income taxes.

D

You might also like to view...

Adriana wants to try working as an independent contractor this summer. She has a 50 percent chance that she will make $9,000 and 50 percent chance that she will make nothing. What's Adriana's expected income?

A) $4,000 B) $4,500 C) $2,000 D) $3,000

Which statement is false?

A. The spreading use of electricity during the 1920s helped create rapid economic expansion in that decade. B. The stock market rose very rapidly in the late 1920s. C. Between 1921 and 1929 national output rose by 50 percent. D. None of the statements are false.

Assume that a college student purchases only Ramen noodles and textbooks. If Ramen noodles are an inferior good and textbooks are a normal good, then the substitution effect associated with a decrease in the price of a textbook, by itself, will result in

a. a decrease in the consumption of textbooks and a decrease in the consumption of Ramen noodles. b. a decrease in the consumption of textbooks and an increase in the consumption of Ramen noodles. c. an increase in the consumption of textbooks and an increase in the consumption of Ramen noodles. d. an increase in the consumption of textbooks and a decrease in the consumption of Ramen noodles.

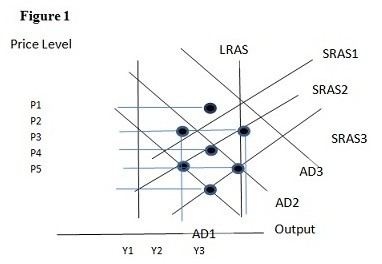

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.