In the labor market, the income tax creates a tax wedge which raises the ________ wage rate, reduces the ________ wage rate, and ________ employment

A) after-tax; before-tax; does not affect.

B) before-tax; after-tax; does not affect

C) before-tax; after-tax; increases

D) before-tax; after-tax; decreases

E) after-tax; before-tax; decreases

D

You might also like to view...

If the production of a good created both external costs and external benefits, but the external costs were greater, without government intervention, a market economy will:

a. not produce the product at all b. overproduce the product. c. underproduce the product. d. produce the optimal amount of the product.

For purposes of calculating the CPI, the housing category of consumer spending includes the cost of

a. shelter. b. fuel and other utilities. c. household furnishings and operation. d. All of the above are correct.

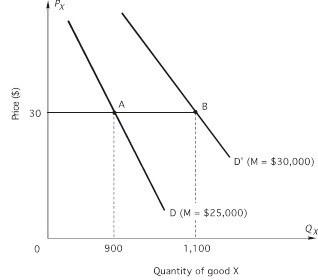

Use the figure to calculate the income elasticity of demand when income increases from $25,000 to $30,000:

A. -1.10 B. 0.1818 C. 1.10 D. 0.20 E. -0.10

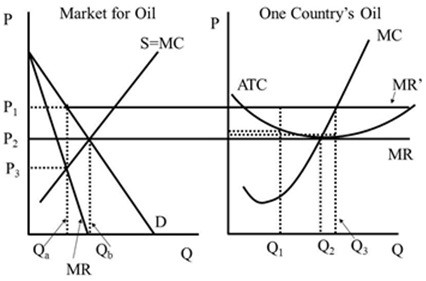

Under perfect competition, the individual firm's quantity is  Figure 42.2

Figure 42.2

A. Q1. B. Q2. C. Qa. D. Qb.