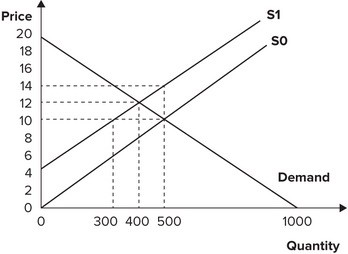

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $10 and a quantity of 500 units. If the government imposes a $4 per-unit tax on this product, producer surplus will fall from:

A. 2,500 to 1,600.

B. 5,000 to 2,500.

C. 3,200 to 1,600.

D. 5,000 to 3,200.

Answer: A

You might also like to view...

"Turnover" unemployment is another name for ________ unemployment

A) frictional B) structural C) cyclical D) natural

If the economy is already producing at its potential, _____

a. the spending multiplier equals 1/(1 - MPC) in the long run b. the spending multiplier is less than 1/(1 - MPC) in the long run c. the spending multiplier is more than 1/(1 - MPC) in the long run d. the spending multiplier equals zero in the long run e. the aggregate demand curve is horizontal

Last year your job at the university cafeteria paid you $9 an hour and the price of a music download was $1.00 . This year your cafeteria job pays $9.90 per hour and download costs $1.10 . You are clearly

a. worse off because of inflation. b. worse off because the download is now relatively more expensive. c. better off because your wage rate went up. d. better off because the download now costs less work.

A craft union can raise union members' wages by restricting labor supply through high initiation fees, long apprenticeship periods, or difficult qualifying requirements

Indicate whether the statement is true or false