Martin must recognize a gain of ________ and has a stock basis of ________:

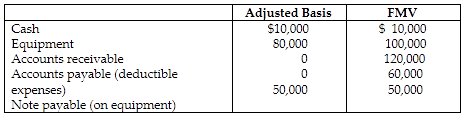

Martin operates a law practice as a sole proprietorship using the cash method of accounting. Martin incorporates the law practice and transfers the following items to a new, solely owned corporation.

A) $0; $30,000

B) $0; $40,000

C) $20,000; $30,000

D) $20,000; $40,000

B) $0; $40,000

The accounts payable are not considered liabilities under Sec. 357(c) since the payment of the payables gives rise to a deduction. Stock basis equals: cash basis $10,000 plus equipment basis $80,000, less liability transferred $50,000 = $40,000.

You might also like to view...

If the ending inventory is understated for any reason,

a. net income will be overstated. b. net income will be understated. c. liabilities will be overstated. d. liabilities will be understated.

If one rates an average employee's performance high because one compared the employee to poor performers, one commits a

A. leniency error. B. contrast error. C. recency error. D. central tendency error.

The creditor is responsible for liquidating all of the debtor's exempt property in bankruptcy proceedings

a. True b. False Indicate whether the statement is true or false

A U.S.-based manufacturer of sunscreen is contemplating using funds to purchase courtside advertising at major tennis matches such as the French Open and the Australian Open

Advertising at such well viewed international events will then raise the domestic sales of the manufacturers products. Which of the following factors is the most relevant when analyzing this decision? A) the cost of the machine used to produce the sunscreen B) the manufacturing process of the sunscreen C) the cost of the existing advertising campaign D) the cost of the courtside advertising at the tennis matches