The allocation of income tax expense across periods when book and tax income differ is called:

A. intraperiod tax allocation.

B. constructive receipt allocation.

C. interperiod tax allocation.

D. current income tax allocation.

Answer: C

You might also like to view...

On March 1, a business paid $3,600 for a twelve-month liability insurance policy. On April 1, the business entered into a two-year rental contract for equipment at a total cost of $18,000 . Determine the following amounts: (a) insurance expense for the

month of March (b) balance in prepaid insurance as of March 31 (c) equipment rent expense for the month of April (d) balance in prepaid equipment rental as of April 30

The use of Lean Six Sigma has ______.

A. increased complacency in the workplace B. created an organizational climate in which innovation has become instinctive C. created a hostile work environment D. eliminated the need for ISO standards

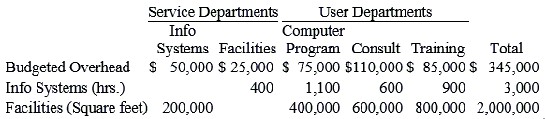

Data Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs-the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department.

width="545" />Information systems are allocated on the basis of hours of computer usage; facilities are allocated on the basis of floor space.Required:Allocate the service department costs to the user departments using the step method. Allocate Information Systems first and round to the nearest whole dollar. Provide total user department costs. What will be an ideal response?

A qualified plan that establishes individual accounts for each plan participant and provides benefits based solely on the amount contributed to the participants’ accounts is referred to as a

A. defined benefit plan. B. defined contribution plan. C. welfare benefit plan. D. employee stock ownership plan.