Which, if any, of the following transactions will increase a taxing jurisdiction's revenue from the ad valorem tax imposed on real estate?

a. A resident dies and leaves his farm to his church.

b. A large property owner issues a conservation easement as to some of her land.

c. A tax holiday issued 10 years ago has expired.

d. A bankrupt motel is acquired by the Red Cross and is to be used to provide housing for homeless persons.

e. None of these.

c

RATIONALE: Although a farm was probably subject to reduced valuation (due to its agricultural use), it will now be fully exempt since it is owned by a church (choice a.). Property that is subject to a conservation easement is usually appraised at a lower value (choice b.). The expiration of a tax holiday means that the property involved can now be taxed (choice c.). The motel has been converted from business property to exempt charitable use (choice d.).

You might also like to view...

Why would the transform IT strategic role be more impactful on stock price than the automate IT strategic role?

What will be an ideal response?

Which of the following best explains why approximately one-third of households in the United States do not have life insurance?

A) People like to focus on more enjoyable events. B) There is no immediate financial benefit. C) People don't want to make the periodic payments. D) People don't want to think about it.

Public relations departments often produce video new releases (VNRs) to highlight corporate news and then provide them free to TV stations, which may air them without disclosing where they came from.

Answer the following statement true (T) or false (F)

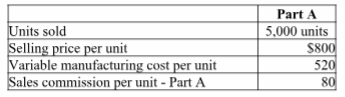

What is the contribution margin for Part A?

Alexis Co. reported the following information for May:

A) $1,000,000

B) $1,400,000

C) $3,600,000

D) $2,600,000