Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1, 20X6. At that date, the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock. Safety's balance sheet at the time of acquisition contained the following balances: Assets$700,000 Liabilities$110,000 Preferred Stock 100,000 Common Stock 200,000 Retained Earnings 290,000 Total Assets$700,000 Total Liabilities and Equities$700,000 The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1, 20X6. All of the $10 par value preferred shares are callable

at $12 per share. During 20X6, Safety reported net income of $80,000 and paid no dividends.Based on the information provided, what amount will be reported as the noncontrolling interest in the consolidated balance sheet on January 1, 20X6?

A. $210,000

B. $191,400

C. $133,800

D. $204,600

Answer: B

You might also like to view...

The declaration of a cash dividend decreases a corporation's stockholders equity and decreases its assets

a. True b. False Indicate whether the statement is true or false

Describe what happens in scenario analysis and explain why firms such as Royal Dutch/Shell Group use the technique

What will be an ideal response?

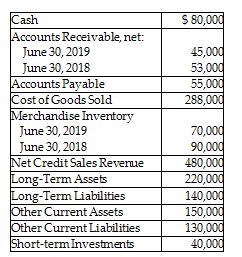

Modern Clothing Store reported the following selected items at June 30, 2019 (previous year - 2018 - amounts are also given as needed):

Compute Modern's accounts receivable turnover ratio for the year ending June 30, 2019. Show your computations. (Round the answer to 2 decimal places.)

Why might measuring service quality be more difficult than measuring product quality?

What will be an ideal response?