Which of the following will cause the demand for loanable funds to increase?

A. Households increase their rate of savings.

B. The expected rate of return increases.

C. The cost of funds increases.

D. The expected profitability of a project declines.

Answer: B

You might also like to view...

Antitrust law is the law that regulates ________ and prevents them from becoming ________

A) oligopolies; monopolies B) monopolies; oligopolies C) monopolistically competitive firms; oligopolies D) oligopolies; monopolistically competitive firms

Some economists believe that the economy benefits from firms having market power. Which of the following is an argument that has been made to support this position?

A) Large firms are better able than small firms to spend funds on research and development required to develop new products. B) Research has shown that the deadweight loss from monopolies is a small percentage of the value of production in the United States. C) Competition is very rare in the U.S. economy and few new products are produced by smaller, competitive firms. D) Large firms can afford to lobby the U.S. government in order to impose restrictions on imports and reduce the outsourcing of jobs to other countries.

If each bank in the United States had to keep 100 percent of checkable deposits as reserves, each $1 the Fed injected into new reserves could increase the money supply by: a. $1

b. $2. c. $100. d. $5. e. a penny.

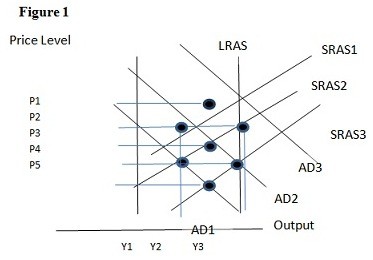

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the short run would be:

A. P4 and Y2. B. P4 and Y1. C. P1 and Y1. D. P3 and Y1.