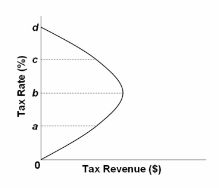

Refer to the diagram. Supply-side economists believe that tax rates are typically:

A. such that an increase in tax rates will increase tax revenues.

B. at some level below b.

C. at some level above b.

D. at d.

C. at some level above b.

You might also like to view...

Suppose that the chain-weighted index for GDP in Panama was 180 in 2015 and 188 in 2016. The inflation rate between those two years was approximately

A) 1.1 percent. B) 4.4 percent. C) 8 percent. D) 10.4 percent.

According to the economy's self-correcting mechanism, how does the economy return to potential output following a negative demand shock? How is the recovery process different, if the government implements a policy of economic stimulus?

What will be an ideal response?

Supply-side economics focuses on the

A. size of the tax multiplier. B. marginal tax rate. C. average tax burden. D. federal income tax share of GDP.

Suppose a monopoly sells to two identifiably different types of customers, A and B, who are unable to practice arbitrage. The inverse demand curve for group A is PA = 10 - QA, and the inverse demand curve for group B is PB = 18 - QB. The monopolist is able to produce the good for either type of customer at a constant marginal cost of 2, and the monopolist has no fixed costs. If the monopolist is

able to practice group price discrimination, the values of the elasticities of the two groups at the profit-maximizing prices are A) ?A = -1.25, and ?B = -1.5. B) ?A = -1.5, and ?B = -1.25. C) ?A = -0.67, and ?B = -0.8. D) ?A = -0.8, and ?B = -0.67.