On January 2, 2014, Nora Co acquired 2,000 shares of Stonewall Co common stock for $8,000 and classified these shares as available-for-sale securities. During 2014, Nora received $6,000 of cash dividends. Nora's share of Stonewall's 2014 earnings (net income) was $5,000 . The fair value of Stonewall's stock on December 31 . 2014, was $7 per share. Nora should report what amount in 2014 related to

Stonewall Co?

a. Revenue of $6,000

b. Revenue of $12,000

c. A $1,000 decrease in the investment account

d. A $1,000 increase in the investment account

A

You might also like to view...

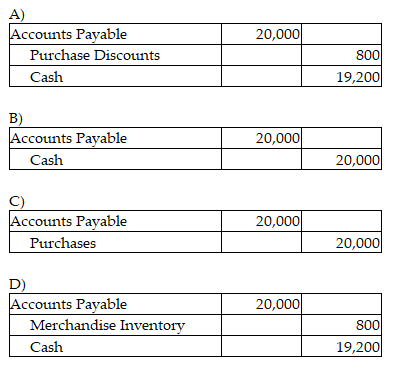

Business Office Supplies, Inc. uses the periodic inventory system. On February 1, the corporation purchased inventory on account for $20,000. The terms of invoice were 4/10, n/30. The amount due was paid on February 9. Which of the following journal entries correctly records the payment in the books of Business Office Supplies?

A firm pursuing a best-cost provider strategy

A. tries to outcompete a low-cost provider by attracting buyers on the basis of charging the best price. B. tries to have the best cost (as compared to rivals) for each activity in the industry's value chain. C. seeks to deliver superior value to buyers by satisfying their expectations on key attributes and beating rivals in meeting customer expectations on price. D. seeks to be the low-cost provider in the largest and fastest growing (or best) market segment. E. seeks to achieve the best costs by using the best operating practices and incorporating the best features and attributes.

An agent who does not perform his or her express duties or fails to use the standard degree of care, skill, or diligence is liable to the principal for damages.

Answer the following statement true (T) or false (F)

Explain the role of quality in operations management. What role did W. Edwards Deming play in the quality

movement? Briefly describe the Deming Chain Reaction.