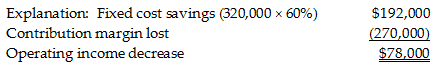

Castillo has just encountered environmental problems with the product and will be forced to drop the product line altogether. Castillo will be able to eliminate 60% of the fixed costs. What will be the impact on operating income of the company?

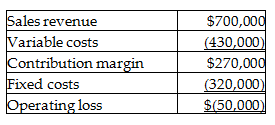

Castillo Corporation has provided you with the following budgeted income statement for one of its products:

A) Operating income will decrease by $192,000.

B) Operating income will decrease by $78,000.

C) Operating income will increase by $192,000.

D) Operating income will increase by $78,000.

B) Operating income will decrease by $78,000.

You might also like to view...

There is a standard threshold for materiality set by the Financial Accounting Standards Board for all companies

a. True b. False Indicate whether the statement is true or false

What is therapeutic touch (TT) and what are the benefits of this type of touch?

What will be an ideal response?

When one party breaches a sales contract, the UCC places the risk of loss on the party responsible for the breach

Indicate whether the statement is true or false

Which of the following is an example of consequential (indirect) loss?

A) the theft of a person's jewelry B) the destruction of a firm's manufacturing plant by an earthquake C) the cost of renting a substitute vehicle while a collision-damaged car is being repaired D) the vandalism of a person's automobile